If you’re a homeowner, using your home equity to secure a loan or a line of credit can be an attractive way to borrow money. This is a good idea when you have a large expense to cover, and you are confident in your ability to repay the loan along with interest on time. Using your equity to invest in home improvements or a second property could even earn you additional money over time.

While there are a few key differences between a home equity loan and a home equity line of credit HELOC, they are both considered secured loans because they rely on your home as collateral backing the loan. Because of this, they both may offer higher borrowing limits and lower rates than unsecured borrowing options such as personal loans or credit cards.

When deciding between a home equity loan vs. HELOC, you’ll want to know the basic distinctions between these personal financing options to find the one that will work best for you.

What is a home equity loan?

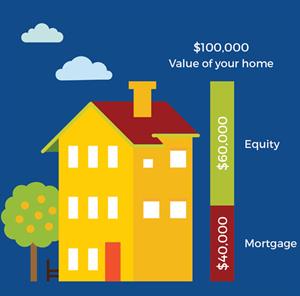

A home equity loan is a type of loan that lets you borrow money against the equity you’ve built up in your home. Equity is the difference between the current market value of your home and the amount you owe on an existing mortgage.

The amount that you’re eligible to borrow will be determined by the amount of equity you have available in your home and the borrowing limits set by your lender of choice.

Features of a home equity loan

- After your loan closes, the entire amount of your loan will be deposited as a lump sum in the account(s) you select.

- Some lenders may let you borrow up to a 90% combined-loan-to-value (CLTV) ratio. This percentage is calculated by adding up the amounts of your existing home loan(s) along with the amount your looking to borrow, and dividing that total by your current home value.

- The interest rate for a home equity loan is typically fixed. This means you will also have a fixed monthly payment while you pay back the loan.

- Repayment periods typically last between 10 to 30 years.

- Many home equity loans will also include closing costs. These can be avoided by choosing a lender than offers to cover these costs for their customers.

- Interest payments may be tax deductible under certain conditions when the loan goes towards home renovation expenses. Check with your tax advisor to receive advice on your potential eligibility for this deduction.

What is a home equity line of credit (HELOC)?

What is a home equity loan?

A home equity loan is a type of loan that lets you borrow money against the equity you’ve built up in your home. Equity is the difference between the current market value of your home and the amount you owe on an existing mortgage.

The amount that you’re eligible to borrow will be determined by the amount of equity you have available in your home and the borrowing limits set by your lender of choice.

Features of a home equity loan

- After your loan closes, the entire amount of your loan will be deposited as a lump sum in the account(s) you select.

- Some lenders may let you borrow up to a 90% combined-loan-to-value (CLTV) ratio. This percentage is calculated by adding up the amounts of your existing home loan(s) along with the amount your looking to borrow, and dividing that total by your current home value.

- The interest rate for a home equity loan is typically fixed. This means you will also have a fixed monthly payment while you pay back the loan.

- Repayment periods typically last between 10 to 30 years.

- Many home equity loans will also include closing costs. These can be avoided by choosing a lender than offers to cover these costs for their customers.

- Interest payments may be tax deductible under certain conditions when the loan goes towards home renovation expenses. Check with your tax advisor to receive advice on your potential eligibility for this deduction.

What is a home equity line of credit (HELOC)?

A home equity line of credit (HELOC) is a revolving line of credit that is secured by the equity in your home. These work similarly to credit cards in the way that you can draw on this line of credit as needed and only pay interest on the amount you borrow.

Features of a HELOC

- On the first day of a home equity line of credit, you are given access to an account with the agreed credit limit. You are typically charged interest only on any withdrawals from the account, which can make the repayment amounts on HELOCs vary from month-to-month.

- Lenders may allow you to borrow up to 85% of your home’s available equity with a HELOC.

- With a variable interest rate, HELOCs may offer a lower starting interest rate than home equity loans. However, that interest rate can change based on U.S. economic trends.

- Some HELOCs allow monthly payments towards the principal of the loan to be delayed until the final day of the loan. While this can lower your monthly payments, it can also create a balloon payment when the loan ends. You should make sure you understand the full repayment schedule for the line of credit when applying for a HELOC.

- A HELOC will define a time during which you can withdraw funds known as a draw period. This typically lasts between 5 and 10 years. In some cases, you may try to apply for a renewal of the line of credit at the end of the draw period, but approval of that renewal will be at the discretion of the lender.

- A HELOC repayment period will vary in length depending on how the loan is structured. During this time, monthly payments are determined by how much is withdrawn and the interest rate at the time of withdrawal.

- Aside from closing costs, HELOCs may charge other fees for things like account maintenance, early payoff, or even nonuse.

- Even though a HELOC may offer a low variable rate to start with, it could turn out to be more expensive than a home equity loan in the long run due to additional fees and an unpredictable rate over the life of the loan.

- Like a home equity loan, interest payments on HELOCs may be tax deductible when the funds are used for home renovation, although you need to consult with a tax advisor to understand what options may be available to you.

Key differences between a home equity loan and a (HELOC)

As you examine the comparison of a home equity loan vs. HELOC, you will notice some important differences between the two products.

Fixed interest rates vs. Variable interest rates

A home equity loan charges interest at a fixed rate, while most HELOCs charge interest at a variable rate.

Fixed interest rates provide you with predictable repayments. This makes it possible to schedule consistent monthly repayment amounts over the life of the loan.

Variable interest rates are based on the interest rate on a standard index like the lending institution’s prime rate or U.S. Treasury bill rate plus a margin set by the lender. This means they can fluctuate as the index changes based on factors in the U.S. economy.

HELOC interest rates also generally set a floor rate as the lowest rate that can be charged to you and a cap for the highest rate that you can be charged.

As you compare variable interest rates for HELOCs, you will

- Which index is used and what is the current variable?

- What is the amount of margin that the lender charges?

- How frequently does the interest rate get adjusted?

- What are the interest rate cap and floor?

Lump sum disbursement vs. Withdrawals as needed

Another difference between a HELOC and a home equity loan is how you receive the money.

- A home equity loan is disbursed as a lump sum. The entire loan amount will be deposited into your preferred account(s) when you receive your funds.

- A home equity line of credit is typically set up as a separate account from which you can withdraw funds only as you need them.

- Additionally, a HELOC will assign a withdrawal window. You will only be able to withdraw funds during that time. When that window expires, you can apply for an extension to the line of credit, but your request may not always be granted.

Fees and penalties

- Both home equity loans and HELOCs may assess a variety of closing costs and can include prepayment penalties if you pay back the loan before the scheduled term.

- Lenders are required to provide you with information about these fees and penalties up front so you can evaluate which terms will work best for you.

- HELOCs may also include annual fees over the life of the repayment period and some may also charge each time you make a withdrawal from your personal line of credit. You will want to pay attention to the requirements before making a decision about taking out a loan.

Finding the best home equity product for you

When looking for a fixed loan vs. a line of credit, you will find that HELOCs are best for upcoming or unexpected expenses that aren’t set in stone while home equity loans are perfect when you have a specific amount to pay.

From there, choosing between these products should be done by comparing offers from different lenders to understand who offers the lowest interest rate and the least amount of additional fees. These are factors that can save you money over the life of the loan.

As always, when choosing any financial product, make sure you research your options and lenders so you can make the decision that’s right for you.

Closing thoughts: Home equity loan vs HELOC

Home equity loans and home equity lines of credit offer qualified homeowners the opportunity to use the equity they’ve built up in their homes as a way to make major purchases or fund large expenses like renovations or debt consolidation.

If you’re interested in accessing funds from your home’s equity, both financing options might be available to you. There are a couple of key differences between these two products, and the best one to apply for will depend on your personal and financial situation.

'Loans' 카테고리의 다른 글

| The pros and cons of debt consolidation (0) | 2024.04.14 |

|---|---|

| How to qualify for a home equity loan (0) | 2024.04.14 |

| The Complete Guide to Discover Personal Loans: Unlock the Financing You Need (0) | 2024.04.14 |

| The Benefits of Online Payday Loans: A Convenient Solution for Financial Emergencies (0) | 2024.04.14 |

| Discover the Best Personal Loan Rates for Your Needs (0) | 2024.04.14 |